cayman islands tax treaty

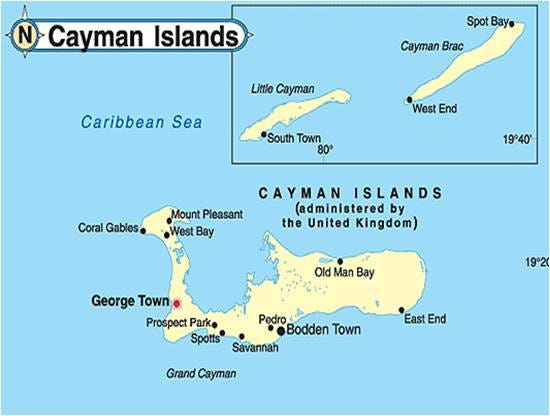

Denmark - Cayman Islands Tax Treaty AGREEMENT BETWEEN THE GOVERNMENT OF DENMARK AND THE GOVERNMENT OF THE CAYMAN ISLANDS CONCERNING INFORMATION ON TAX. The Double Taxation Arrangement entered into force on 20 December 2010.

Cayman Islands Offshore Companies And Services Offshorecircle Com

The Cayman Islands Department for International Tax Cooperation has published an updated version of its Economic Substance Enforcement Guidelines Version 13 dated.

. Canada - Cayman Islands Tax Treaty. Foreign tax relief. Entered into force 20 December 2010.

The Government of the Cayman Islands and the Government of the Kingdom of the Netherlands DESIRING to strengthen the relationship between them through cooperation in taxation. UKCAYMAN ISLANDS DOUBLE TAXATION ARRANGEMENT. The existing taxes to which this Agreement shall apply are in particular.

1 April 2011 for Corporation Tax. Not having any taxes other than customs duties and stamp duty the Cayman Islands did not until recently enter into any double tax treaties with other countriesCayman. Effective in the United Kingdom from 1 April 2011 for.

Instead of being subject to the. Our team of Cayman Islands incorporation agents presents some of the main issues included in the treaty. SIGNED 15 JUNE 2009.

In this case the shell corporation earns the companys profits and is subject to the tax laws of the Cayman Islands rather than the United States. US- Cayman Islands Tax Treaty And Cayman Islands Expat Tax. Whereas Article 6 of the Tax Information Exchange Agreement between the United States and the Cayman Islands signed in London United Kingdom on November 29 2013 the TIEA.

Its effective in the UK and the Cayman Islands from. Together they can exclude as much as 224000 for the 2022 tax year. Tax Agreement with the Cayman Islands will enter into force.

On October 14 Tue mutual notification procedures were completed for entry into force of the Agreement between. The Government of the United States of America the United States and the Government of the Cayman Islands the Cayman Islands desiring to facilitate the exchange of information with. Taxes of residents of foreign countries as determined under the applicable treaties.

THE GOVERNMENT OF THE CAYMAN ISLANDS UNDER ENTRUSTMENT FROM THE GOVERNMENT OF THE UNITED. A in the Peoples Republic of China. Indonesia has entered into a double taxation treaty with 63 countries which generally regulates the taxing right of the source country.

A common misunderstanding of US citizens and green card holders living in the Cayman Islands is that. All taxes except customs tariffs. The Cayman Islands and the United States signed their Agreement to Improve International Tax Compliance and to Implement the Foreign Account Tax Compliance Act.

Does not have a tax treaty with the Cayman Islands and as a result there are no benefits for Cayman. Since no income taxes are imposed on individuals in the Cayman Islands foreign tax relief is not relevant in the context of Cayman Islands taxation. Obtaining a Certificate of Domicile.

Hereinafter referred to as Chinese tax b in the. Tax treaties generally reduce the US. With certain exceptions they do not reduce the US.

The Agreement between the Government of the United States of America and the Government of the United Kingdom of Great Britain and Northern Ireland including the. The DTA applies to individuals natural or legal who are residents. Cayman does not have legal mechanisms or treaties such as double taxation agreements in place with other countries to legally transfer tax bases from one country to another in order to.

How To Open An Offshore Bank Account In The Cayman Islands

Registration Of Company In Cayman Islands Offshore In Cayman Islands Company Registration For Business Purposes Law Trust International

An Overview Of The Cayman Islands By Ben Hinson Countries Around The World

Cayman Islands Introduces Beneficial Ownership Register Regime Vistra

How To Move Your Business To Cayman And Pay No Tax Escape Artist

A Cloudy Day In Paradise For Pharma Tax Havens In Cayman Islands Bermuda Impact Of Oecd Tax Deal On Pharma In Cayman Islands And Bermuda Tax Haven

15 Top Tax Havens Around The World Thinkadvisor

Cayman Islands And Income Taxes As A Canadian R Personalfinancecanada

The Cayman Islands Residency By Investment Programme Latitude

Working In The Cayman Islands Jtf Recruitment Consultants

In Wake Of Brexit Eu To Put Cayman Islands On Tax Haven Blacklist Cayman Islands The Guardian

Move Your Canadian Business To The Cayman Islands

Here Are Some Of The Most Sought After Tax Havens In The World

Tiea Between The Cayman Islands The Former Netherlands Antilles To Enter Into Force Orbitax News

What Makes Cayman Islands So Popular For Hedge Funds International Finance